Pain-points Addressed

-

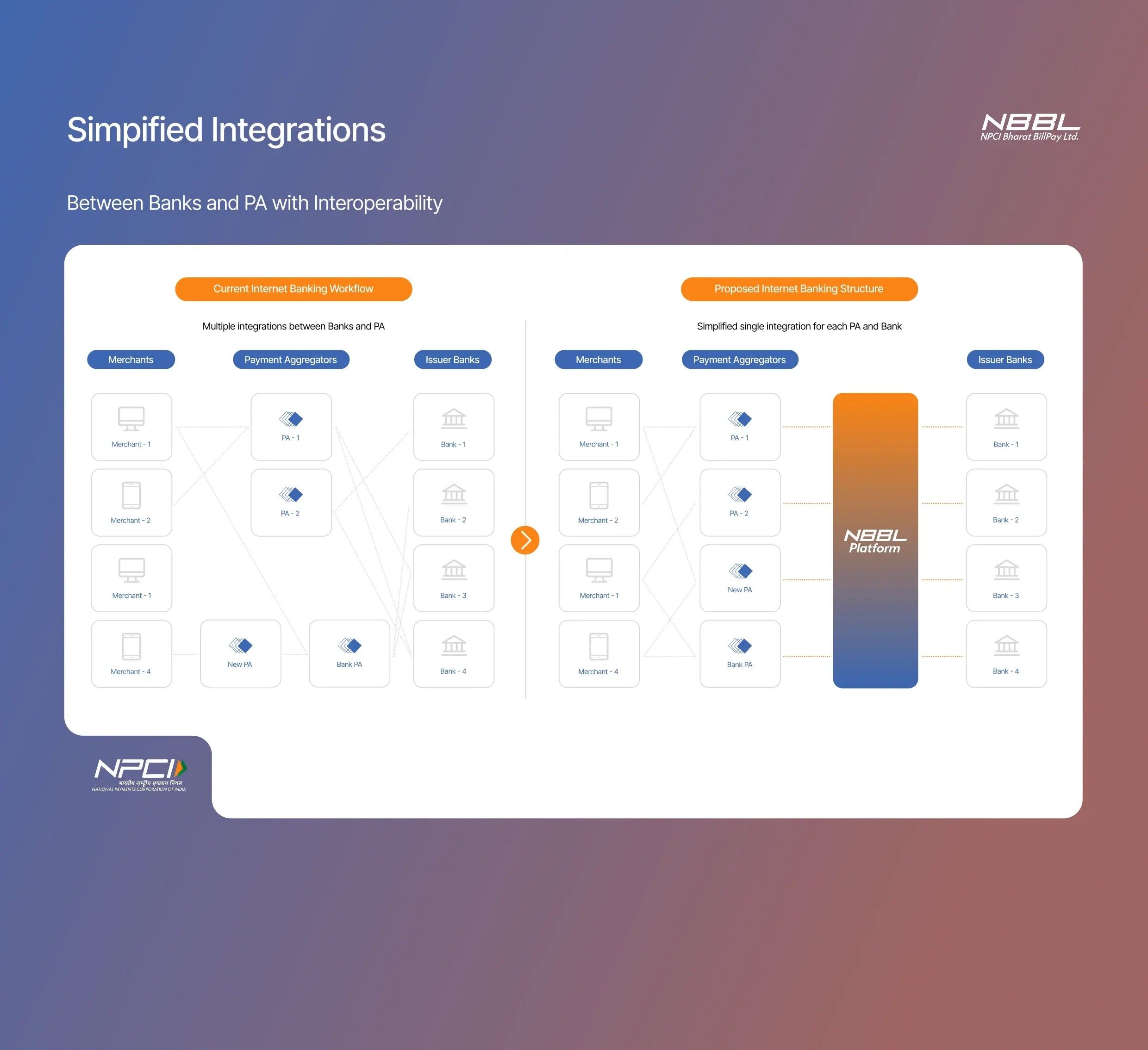

Lack of Interoperability

Multiple one-to-one integrations between banks and payment aggregators for online merchant transactions.

-

Poor customer journeys

Customer friction as transactions require input of complex customer ID and passwords.

-

Non-standardized settlement process

Delays and high settlement risks given varying processes by banks, taking 1–5 days to settle the funds.

-

Dispute management inconsistencies

Delays in failed transaction resolution due to lack of transparency and inconsistent processes.

-

Other operational challenges

Elongated merchant onboarding process (1-1 with each bank), non-standardized error codes for Pas.

Banking Connect Structure

Current Internet Banking workflow has multiple integrations between banks and PAs. The proposed Banking connect structure simplifies these integrations.

- Single Integration for Banks & PAs

- Interoperability across ecosystem participants

- Same-Day Settlement

- Standardized Error Codes

- API-based Merchant Onboarding

- Enhanced Security & Compliance

Benefits

How to get started?

1

Sign up with NBBL to participate in Banking Connect.

2

Complete the onboarding process as per guidelines.

3

Start integrating and go live to enable payments.